Backed by giants

We work with the most reputable carriers

Seamless, Simple Insurance

Help borrowers get impartial, accurate quotes in seconds with our custom servicer tools

Your sub-servicing clients will love you

We're laser-focused on helping servicers amaze their clients with convenience, transparency, and customer service

Multi-award winning user experience

Apples to apples quotes from trustworthy carriers

VIP customer service from licensed professionals

Better service = happier clients and borrowers

Seamless, simple insurance

Voluntary homeowners insurance options automagically. Here's how:

-

A

It's Easy Peasy

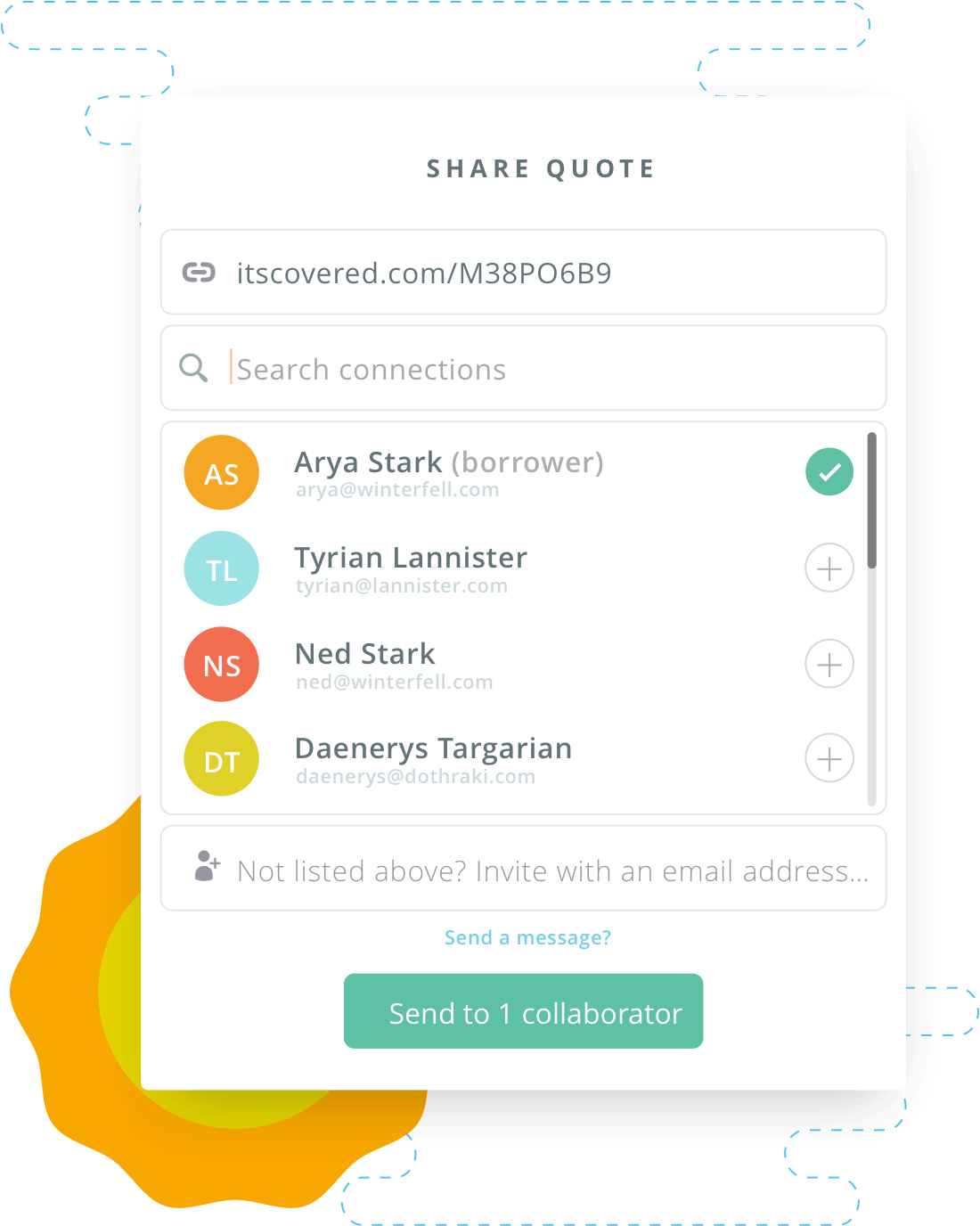

-

B

Stellar Service

-

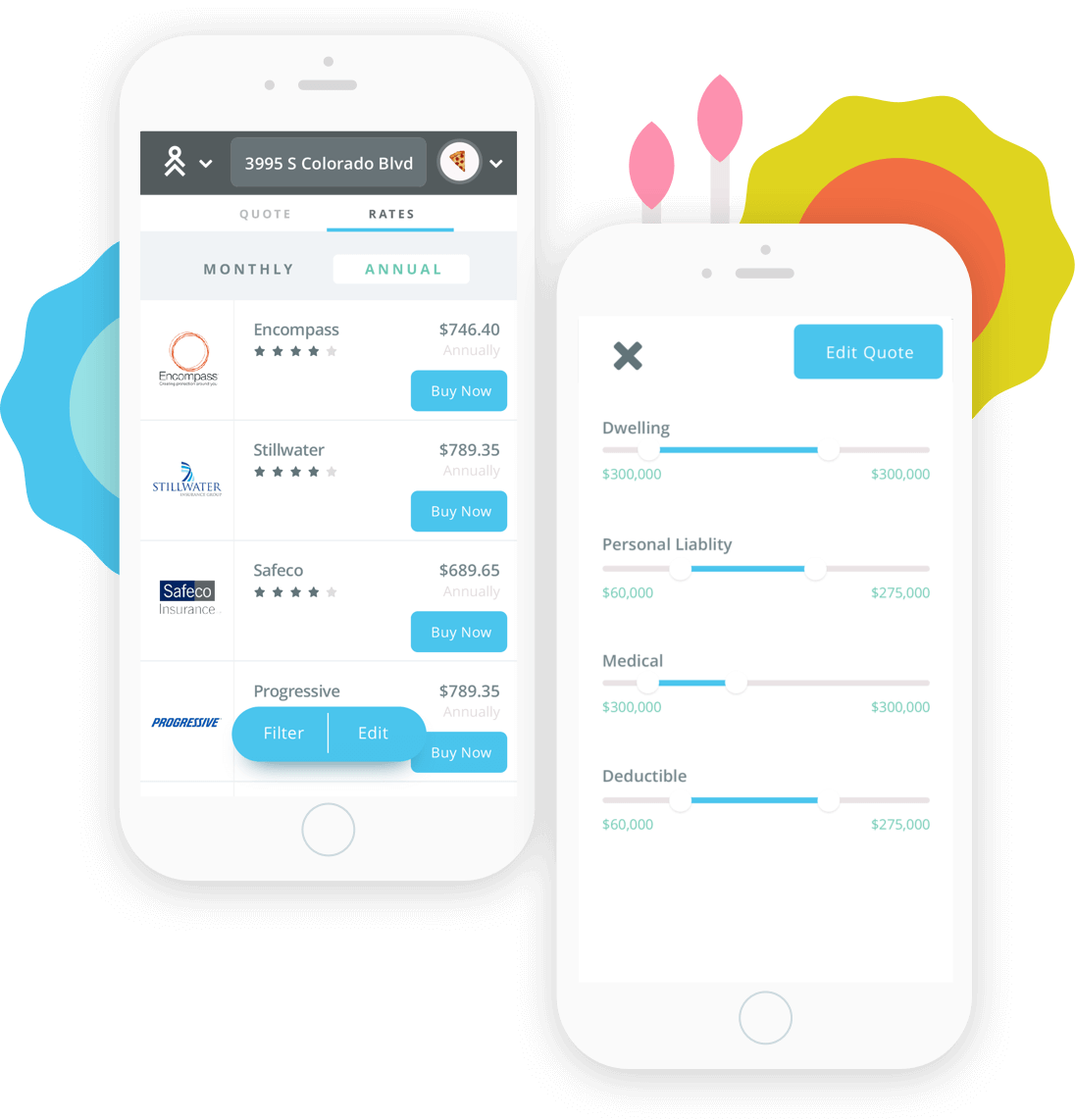

C

Shop Apples to Apples

-

D

Update Policy

-

E

Increase Your Profit

-

F

Covered Handles the Rest!

Easy to implement

Covered receives borrower information and obtains quotes from over a dozen carrier partners

Proactive Client Engagement

Multiple quotes are sent to your borrowers exactly when they need it - prior to their renewal date. Proactive and voluntary options provides transparency and avoids lender placed insurance.

Borrower Shops Apples-to-Apples Options

Working with multiple reputable carriers means that your borrowers can shop with confidence and bundle whatever they like. They'll get the best coverage at the best price.

Update Policy

We are a full service agency, so your borrower can purchase a policy directly through Covered. We'll send you updated proof of insurance and escrow info on all new policies.

Improve Profitability

Get paid by Covered for providing your borrowers with savings and an amazing experience. It's a win-win-win for you, your sub-servicing clients, and your borrowers.

We handle the details

We take care of everything else - Compliance, vendor oversight, licensing, policy updates, security, customer support, IT and servicing platform integration. All of it!

Rest easy with full compliance and security

Covered protects your client's data using the latest technology. We ensure all transactions meet RESPA, GLB, CFPB, and UDAAP regulations.

Mind Blown?

Talk to us today to see how we can improve your borrower experience, add more value to your service, and help you generate new revenue.